Polish bank BGK steps into Rwandan market

BGK’s pioneering loan will support Rwanda’s development.

The Polish Development Bank (BGK) has provided direct financing to the Rwandan state treasury for the purchase of a Polish milk cooling system. The loan to the buyer with a policy from the Export Credit Insurance Corporation is €23 million and is the first such financing provided by any bank in Poland.

The value of the order significantly exceeds the annual value of Polish exports to Rwanda to date, which has hovered around several million euros.

The loan structure for the buyer, namely the government of another country, is pioneering financing in the Polish banking sector and will increase the annual value of Polish exports to this market from several to tens of millions of euros. Rwanda is seen as one of the most friendly countries for doing business in Africa. Increased interest in this market by Polish exporters has been observed for quite some time, mainly industries related to agriculture, mining and services.

“I am glad that BGK is supporting Polish entrepreneurs with international ambitions, blazing new trails in domestic banking and at the same time responding to the development needs of poorer countries,” says Marek Tomczuk, a member of BGK’s management board.

Support for the Rwandan economy

The contract for the purchase of a Polish milk cooling system is of strategic importance for Rwanda’s socio-economic development. The delivery of nearly 400 installations to local milk collection centers is expected to reduce milk losses due to improper storage and increase production capacity and access to dairy products.

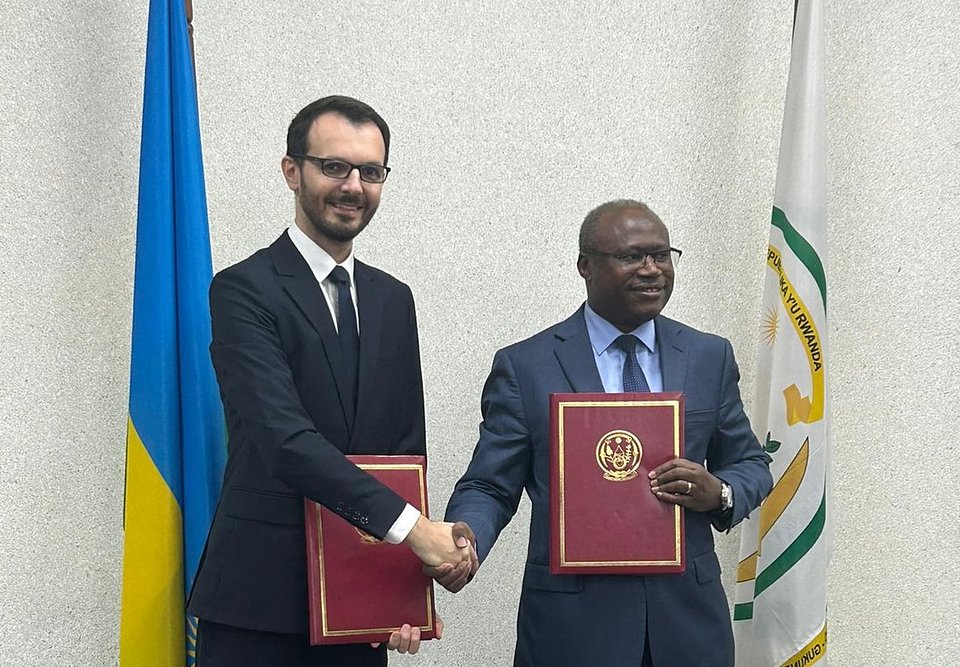

“The agreement we signed is a testament to the rapidly growing bilateral cooperation between Rwanda and Poland. Both sides are exploring further opportunities for economic cooperation,” says Dr. Uzziel Ndagijimana, Rwanda’s Minister of Finance and Economic Planning.

The Polish exporter and beneficiary of the loan funds is Faspol, a Łódź-based company. It is a medium-sized company that designs and manufactures specialized tanks for the food and chemical industries, among others. The contract financed by the BGK loan the Polish manufacturer concluded with the Rwanda Agriculture and Animal Resources Development Board. Rwanda is not Faspol’s first export market. The company has been operating in Africa since 2016 and has supplied products and services to customers in Kenya, Tanzania, Ghana and Senegal. Its largest contract in Africa was the delivery of 350 milk cooling plants in Kenya under a loan agreement between the Polish and Kenyan governments.

“It was an intense two years of visits to Rwanda, preparation of concepts and projects, and not easy negotiations. Therefore, we are happy that Rwanda will be the next market where our solutions will contribute to food security. Thanks to our installations, daily milk production will increase by almost two million liters. This means that this raw material will become more accessible to Rwandans,” says Marcin Kaleta, co-owner of Faspol.

Exports secured by policy

In the transaction, the debtor is a public entity – Rwanda’s Ministry of Finance and Economic Planning – and this significantly reduces the risk of default. However, the BGK loan is additionally secured by a policy from the Export Credit Insurance Corporation against political risk. Insurance guaranteed by the Polish Treasury is commonly used to finance exports and investments to developing countries. The Export Credit Insurance Corporation’s instruments protect against the effects of trade risks, political risks or the effects of so-called “force majeure” – such as war or natural disasters that can prevent payments from being made.

“Although Rwanda belongs to the group of least developed countries, at the same time it is seen as a market with relatively low investment risk and good prospects for business. So far, it has avoided the troubles of many other African countries that have teetered on the brink of insolvency as a result of over-indebtedness, pandemics, the consequences of the war in Ukraine and global interest rate hikes. Backed by BGK and the Export Credit Insurance Corporation, the Polish producer’s transaction will serve to modernize agricultural production in Rwanda and develop local communities. We are working on further investment projects that, by stimulating our exports, will also contribute to raising the standard of living of the country’s population,” says Janusz Władyczak, president of the Export Credit Insurance Corporation.

Since 2009, BGK has supported more than 120 export transactions in 19 African countries, most in the markets of Egypt, Kenya, Angola, Mali and Tanzania. The contracts have been carried out by Polish entrepreneurs in the food, medical, furniture, manufacturing, agricultural, hi-tech and transportation industries.