On the Premium Real Estate Market

The growing wealth of Polish citizens, inflation, and the interest of foreign investors are driving dynamic growth in Poland’s premium real estate market. Luxury apartments are becoming not only a symbol of prestige but also an alternative form of capital investment. But is this the right time to invest, given that supply is increasing and prices are hitting record highs?

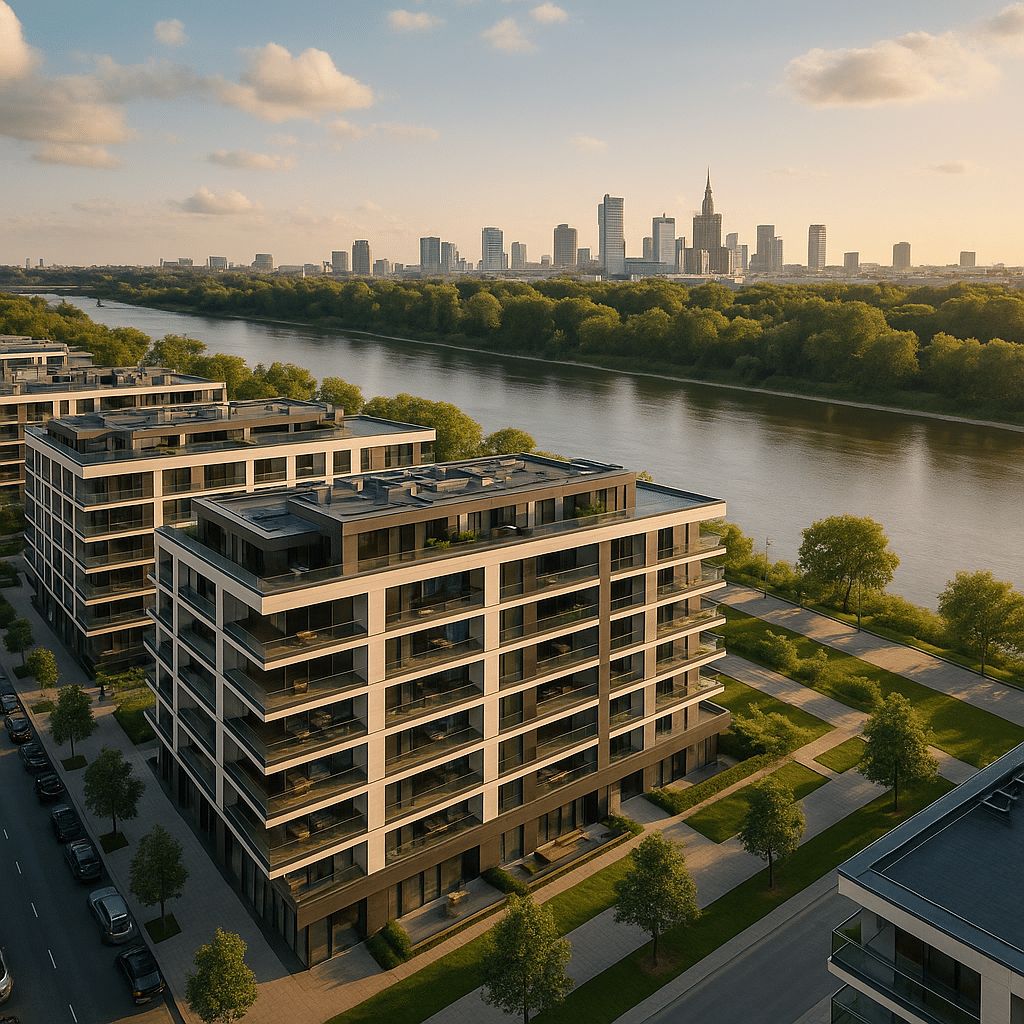

Marek Zuber: Polish society is becoming increasingly affluent. As a result, interest in luxury real estate as a form of capital investment is growing. New premium developments along the Vistula River are also attracting foreign investors who are looking for both residential and commercial properties in tourist destinations. They are particularly interested in PRS (Private Rented Sector) properties and apartments intended for rental.

The market for companies specializing in property management services is also expanding rapidly. This is a key element of the puzzle, as most buyers of apartments in tourist areas do not manage them themselves—they entrust this to specialized firms. This applies as well to the most expensive housing markets in Poland, such as Warsaw and Kraków.

A separate group of foreign investors is made up of Ukrainians. Right after the war broke out, Poland appeared to them as a relatively safe place to allocate capital. To this day, they remain highly active in our premium real estate market.

Soaring inflation has also contributed to the surge in demand in this segment. We are seeing a growing number of business sales involving companies founded in the 1990s. Their owners now have significant cash reserves and are eagerly investing in premium properties, treating them as an alternative to government bonds or bank deposits. Personally, I wouldn’t equate these instruments—investing in premium apartments, in my opinion, involves

a higher level of risk. Nevertheless, such transactions are happening: a new premium development appears, and someone buys three, four, even five apartments in cash. These kinds of cases are particularly noticeable in Warsaw, Kraków, and Gdańsk.

The strong demand for luxury real estate has driven prices up significantly—today, top-tier apartments in Warsaw can cost as much as 50,000–60,000 PLN per square meter. There have even been individual transactions for even higher amounts. Still, these prices remain far lower than in the top locations in Western Europe.

Changing expectations of affluent clients—who now demand higher finishing standards, security, prestigious locations, and aesthetically pleasing surroundings—are pushing developers in this market to offer increasingly luxurious standards, which in turn drives prices even further.

In summary, the premium real estate market in Poland is currently in a phase of rapid development, fueled by both internal and external factors. The long-term outlook for this segment remains optimistic. Investors who have a good grasp of the market’s specifics and can properly assess the risks still have opportunities to find attractive deals.