Invest Smart: Poland’s Real Estate Market Is Booming

In an era where capital diversification is a strategic priority, a growing number of investors are turning their attention to Poland’s real estate market, which has long appealed to international buyers. In 2024 alone, foreign nationals purchased 17,330 residential properties, suggesting that foreigners now account for approximately 5% of the Polish housing market.

Catherina Wilson remarks: “Investing in assets beyond one’s home country is not only a way to increase potential returns but also a safeguard against inflation, political risks, or local economic crises. That’s why more people are seeking safe and attractive regions that offer long-term real estate opportunities.”

The Polish market is seeing the highest interest from Ukrainians, Belarusians, and Germans. However, according to the latest data from the Ministry of the Interior and Administration, nearly 120 nationalities are now represented among foreign property buyers in Poland.

“There’s no doubt that the war just beyond our eastern border and the political situation in Belarus are contributing to the increasing number of transactions involving foreign buyers,” explains Bartosz Turek, Chief Analyst at HREIT. “For many buyers, Poland’s strong economy, low unemployment, rising wages, and relatively low cost of living by European standards are also key factors.”

In 2024, Ukrainians accounted for about half of all property purchases by foreigners, acquiring around 9,000 units—an increase of more than 25%. Belarusians followed in second place, purchasing approximately 3,000 apartments, marking a 60% rise compared to 2023. Meanwhile, the number of German buyers declined, with Germans acquiring properties totaling no more than 57,000 square meters in 2024—a drop of nearly 25% compared to the previous year. Interestingly, German investments in Poland differ from those of Ukrainians and Belarusians. Germans recognize Poland’s tourism potential and often invest not just as visitors, but in areas with easy access to leisure amenities—by lakes, the sea, or in the mountains.

“Luxury developments by the sea, in the Kashubian region, or in the mountains are no longer just private retreats for owners,” notes Katarzyna Szkudlarek, Area Manager at Sun & Snow. “More and more, they combine leisure functions with short-term rental opportunities. Germans, as key clients in Western Pomerania, help ensure year-round demand in places like Świnoujście and Kołobrzeg.”

Why Are Foreign Buyers Investing in Polish Real Estate?

Competitive Pricing

Although property prices in Poland have risen in recent years, they remain relatively attractive compared to other EU markets, making them an appealing alternative to Western Europe’s pricier real estate sectors. In large cities like Warsaw, prices are beginning to approach Western European levels, but they are still significantly lower than in Germany, the UK, or France.

Poland

Housing prices in Poland vary by region, but the average price per square meter in major cities (Warsaw, Kraków, Wrocław) in 2024 ranged from PLN 12,000 to 15,000. In smaller towns, prices are considerably lower—PLN 6,000 to 8,000 per square meter.

Germany

Germany remains one of the most expensive housing markets in the EU. In 2024, average prices per square meter in Berlin or Munich ranged from €4,500 to €7,500, with an upward trend in major cities.

France

Paris tops the European charts in housing costs, with average prices per square meter around €10,000. In other major cities like Lyon or Marseille, prices range from €3,500 to €5,500 per square meter.

Spain

Prices in Spain vary by region. In Madrid, they average €3,500/m², €3,000–4,000 in Barcelona, and as low as €1,500–2,500 in smaller cities.

United Kingdom

London remains one of Europe’s priciest cities, with an average of £11,000/m² (around €13,000). In cities like Manchester or Liverpool, prices range from €2,000 to €4,000 per square meter.

Netherlands

In Amsterdam, average prices are around €5,000/m². In other cities like Rotterdam or Utrecht, they drop to approximately €3,000/m².

Italy

In Rome and Milan, housing prices range from €3,000 to €5,500 per square meter, while in places like Naples or Palermo, they can fall to €2,000/m².

Economic Stability

As a member of the European Union, Poland offers a stable economic environment. In 2023, foreign investment supported by the Polish Investment and Trade Agency (PAIH) reached a record high of €7.4 billion—evidence of strong investor confidence.

Poland remains one of Europe’s fastest-growing economies, offering relative stability and legal transparency. Investors are drawn by the country’s political predictability and legal protections. Property ownership laws are well-defined, and the real estate registration process is transparent and aligned with international standards. Foreign buyers also benefit from access to investment funds, legal advisory services, and financial instruments that support their ventures in Poland’s property market.

Dynamic Urban Development

Rapid development of urban infrastructure, population growth, and the increasing importance of cities as business and cultural centers are key factors attracting investors looking for real estate with high value-growth potential. Due to these dynamic changes, Poland is becoming increasingly attractive to both domestic and foreign investors. The modernization of roads, expansion of public transportation systems, and construction of new metro lines, trams, and urban railways are enhancing the accessibility of various city areas, directly contributing to increased property values in those locations.

In particular, the development of transportation infrastructure—such as modern transit hubs, city bypasses, and airports—significantly boosts the attractiveness of nearby areas. For investors, this presents an excellent opportunity to allocate capital into real estate whose value will increase as access improves.

Investments in green spaces, such as city parks, or the modernization of public areas also raise the appeal of given neighborhoods, potentially driving up real estate demand and, consequently, property values.

Investment Preferences Among Foreign Buyers

Foreign investors show interest in a variety of property types, depending on their investment goals.

City Center Apartments

There is strong demand for apartments in central locations, especially in cities like Warsaw, Kraków, and Wrocław. Central locations offer easy access to key institutions, businesses, shopping centers, restaurants, cultural venues, entertainment, and other amenities, making them ideal for both living and working. For foreign investors seeking stable and profitable assets, city centers represent a secure investment due to high rental demand.

City center apartments appeal to both working professionals and tourists, offering strong potential for short-term rentals. As cities become increasingly diverse in terms of business, culture, and society, investing in central real estate becomes even more advantageous.

Investing in central city real estate is a long-term strategy where property value growth can provide high returns over time. As cities continue to grow and modernize, central areas become more desirable, and properties in these locations gain in value.

Vacation Apartments

Regions with high tourism appeal, such as the Tri-City area, the Masurian Lakes, and the Tatra Mountains, attract investors interested in short-term rentals. In 2024, foreign nationals purchased a total of 121 properties in Świnoujście, Zakopane, and Gdynia.

“The recreational real estate market in Poland is developing rapidly, responding to the growing demand for properties that offer not only comfortable leisure but also income potential,” says Katarzyna Szkudlarek. “Investment clients increasingly seek locations surrounded by nature that ensure tranquility and unique experiences.”

There is growing interest in properties situated in picturesque, peaceful locations away from large urban centers. The rising popularity of the slow life trend and the blending of tourism with remote work mean that recreational investments are becoming year-round business ventures.

“Today’s clients are looking for more than just an apartment—they want an investment that functions all year round and includes a tourism component,” Szkudlarek adds.

Thanks to the popularity of these locations among tourists, the demand for accommodations remains high throughout the year, ensuring stable rental income. Real estate investments in these areas offer attractive returns, especially during tourist seasons, and are viewed as a safe option for long-term profit.

“It’s worth investing in places with potential. Interestingly, towns that may seem saturated with apartments and hotels are often those experiencing further dynamic growth due to continued investment and rising tourist numbers,” says Jacek Tokarski, CEO of Hotel Investment & Development Advisory and a market expert. “Białka Tatrzańska is a great example—it’s developing so quickly that it has become a serious competitor to Zakopane. Investors should also consider locations with few modern developments, like Święradow-Zdrój.”

Luxury Real Estate

Interest in premium real estate is growing, particularly in Warsaw, Kraków, and Sopot. These properties are considered a safe way to allocate capital, which is reflected in increasing demand for apartments in prestigious locations.

“The premium real estate market is entering a new phase of development. It is maturing,” says Katarzyna Goryszewska, Head of the Luxury Residential Agency at Walter Herz. “We’re seeing a trend where capital is being placed in safe areas that are free from climate-related risks. Locations offering proximity to nature are also becoming more appreciated.”

“The value of some apartments sold in the past year significantly exceeded previous records. Transactions involving luxury properties often reached over PLN 20 million. Premium-class homes and apartments changed hands at prices exceeding PLN 60,000 per square meter. Rising prices are the result of current market conditions, and we shouldn’t expect this trend to reverse anytime soon,” Goryszewska adds.

“Real estate offerings must not only promise exclusivity, quality, and experience, but they must also deliver on that promise,” emphasizes Sebastian Kopiej, CEO of PR Commplace.

Commercial Properties

Investments in offices, retail spaces, and warehouses remain attractive, offering stable rental income. Due to its strategic location, Poland is also becoming a significant logistics hub, increasing the appeal of investments in warehouse properties.

Poland is one of the leading centers for warehouse and office real estate investments in Central and Eastern Europe. Demand for modern office spaces in cities like Warsaw, Kraków, and Wrocław is strong, supporting higher returns on investment. The warehouse sector benefits from the rapid growth of e-commerce, which translates into a rising number of investments in this type of property.

Most Popular Investment Destinations

Which Polish cities are most popular among foreign investors?

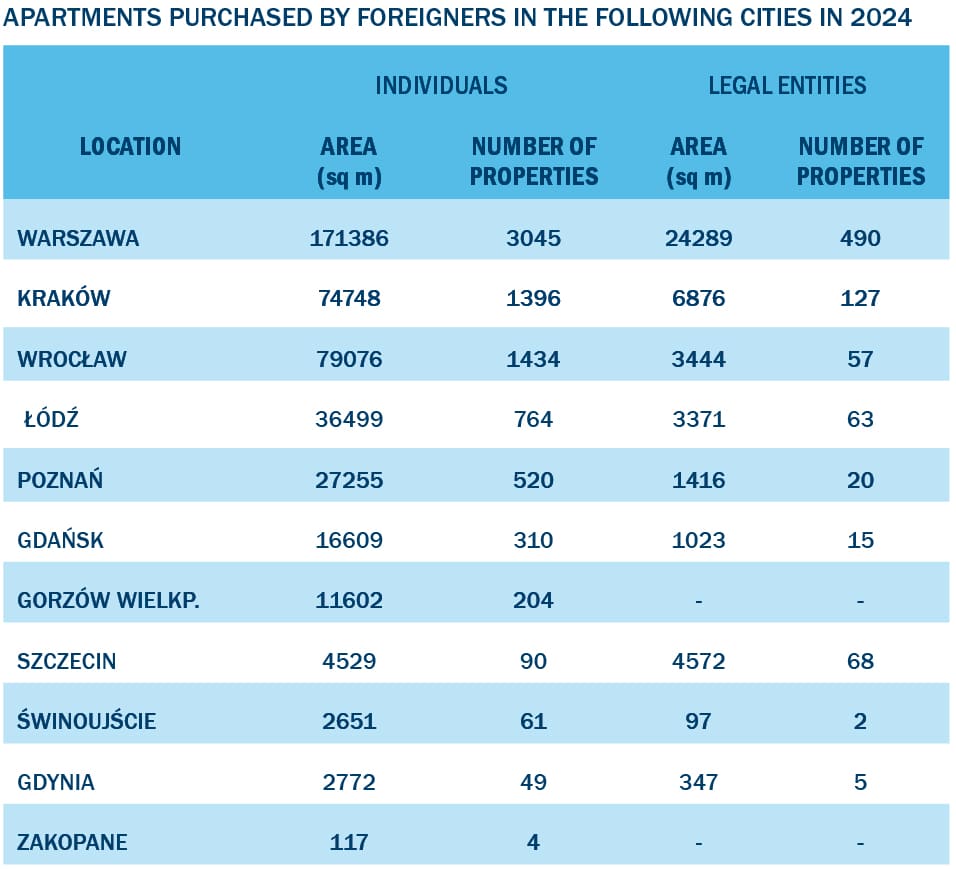

Warsaw has held the top spot for years. In 2024, individual foreign buyers acquired over 3,000 apartments, with foreign companies purchasing an additional 490 units in the capital. Altogether, foreigners bought more than 3,500 residential properties in Warsaw—a more than 20% increase compared to 2023. Kraków ranked second with over 1,500 apartments sold, followed closely by Wrocław. Other cities on the list include Łódź, Poznań, Gdańsk, Gorzów Wielkopolski, and Szczecin, with between 158 and 827 properties acquired by foreign nationals.

Warsaw: As Poland’s business and political capital, Warsaw offers a broad range of premium properties and a rapidly growing rental market. “Warsaw consistently attracts investors from around the world, tourists, and new residents, particularly those focused on career growth or improving their quality of life,” says Artur Smoleń, Director of the Wrocław branch of PROFIT Development. “The capital boasts an attractive job market, vibrant cultural and social life, modern infrastructure, and all the opportunities of a major, fast-growing city.”

Warsaw is also the most popular city for students, and experts predict its population will continue to grow significantly. Unsurprisingly, investors are closely watching the city’s residential market, aiming to capitalize on the upward trend. In 2023, the average price per square meter of residential property was PLN 13,891. In 2024, it rose to PLN 16,001—an increase of 13.19%. The rental market is also seeing steady growth. The current average monthly rent for a two-room apartment (40–50 m²) in the capital is PLN 3,852. Owning property in Warsaw therefore offers a reliable source of monthly passive income, whether through long- or short-term rentals, and presents strong resale value in the long term.

Kraków: With its rich history and strong tourism potential, Kraków attracts investment in vacation apartments and rental properties.

Wrocław and Gdańsk: These fast-growing urban areas have flourishing residential and commercial real estate markets. In a recent report by UK-based Oxford Economics, which evaluated the 1,000 largest cities globally for livability, Wrocław ranked in the top 100 and was named the number one city in Poland. Its dynamic job market, prestigious universities, and presence of international companies fuel growing demand for high-standard apartments. In 2023, the average price per square meter in Wrocław was PLN 11,642; by 2024, it had increased to PLN 12,797—a 9.03% rise. The average monthly rent for a two-room apartment now stands at PLN 2,921. Demand for both short- and long-term rentals remains high and shows no sign of waning, Smoleń emphasizes.

Tri-City (Gdańsk, Gdynia, Sopot): This coastal region offers attractive investment opportunities in both residential and commercial sectors, thanks to its strong appeal for tourism and business.

Outlook for the Future

Forecasts for 2025 indicate continued growth in Poland’s real estate market, with the number of foreign transactions expected to stabilize at around 16,000 to 17,000 properties. Ongoing demand for real estate, particularly in cities like Warsaw, Kraków, and Wrocław, keeps the market appealing to investors from both Europe and beyond.

Interest is also expected to rise among investors from Asia and the Middle East, especially in the premium property segment. These investors tend to have a greater appetite for luxury real estate, which offers high returns and long-term stability.

Thanks to dynamic urban infrastructure development, a stable economic environment, and growing demand for residential and commercial space, Poland remains one of the most desirable investment destinations in Central and Eastern Europe. Investors can count on attractive rental yields, particularly in central urban areas and popular tourist regions. In summary, Poland’s real estate market presents diverse investment opportunities that continue to grow in appeal for foreign investors.