Investment Apartment– Choose Carefully and Consider Regional Markets

The residential real estate market in Poland is undergoing dynamic changes; however, investment apartments remain an attractive form of portfolio diversification and a means of capital preservation. A conscious approach to investment is becoming key—both in terms of location and type of property. For many investors, regional markets—where apartment prices are still significantly lower than in Warsaw, for example—may prove especially attractive.

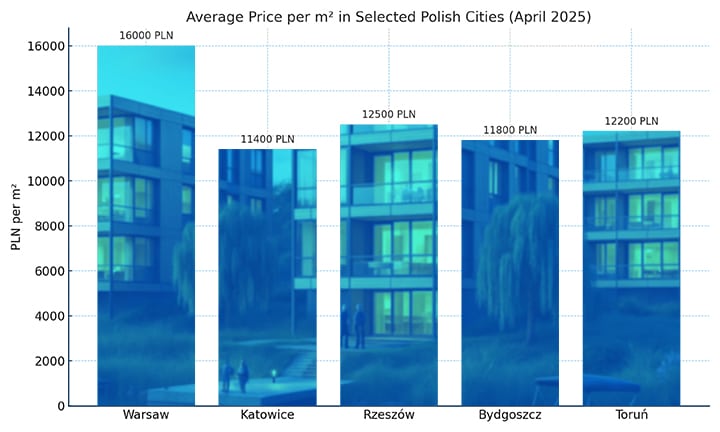

Investment Apartments – How Are Prices Shaping Up?

According to data published in April 2025 by Rankomat and Rentier.io, apartment prices in major markets remain high. The price per square meter for a medium-sized apartment in Warsaw exceeds PLN 16,000. In comparison, in Katowice it’s PLN 11,400. Interestingly, while major cities are seeing slight price corrections (down 2% year-over-year in the capital), many smaller markets are moving in the opposite direction. For instance, price increases in Toruń, Bydgoszcz, and Rzeszów range between 10–12%. Katowice tops the chart, with a 24% year-over-year increase in the medium-sized apartment segment. Still, the price per square meter remains much lower than in the capital.

“When selecting an investment property, it’s important to consider not only purchase prices, but also potential rental income and the rent-to-mortgage ratio. Local job market conditions, unemployment levels, and salary trends are also crucial factors.” — Marcin Krasoń, Expert at Otodom Analytics

Rental Market Holding Steady

According to Otodom’s analysis, despite a drop in the number of listings in May, demand-side activity increased. In May, platform users responded to 322,000 rental listings—15% more than the previous month and 16% more than the same period last year.

Rental prices have remained stable—monthly changes are minimal (fluctuating slightly up or down), and year-over-year increases of 10% or more were only observed in Bydgoszcz and Olsztyn. In other major cities, changes rarely exceed 5%. According to the platform, the current average rental rate in Poland stands at PLN 3,600.

Meanwhile, Rankomat and Rentier.io data show that annual rent growth is modest—around 3% in the largest and most expensive markets. In contrast, rental prices are rising more dynamically where rates are still relatively affordable. For example, Szczecin saw

a 6% increase, while Katowice recorded a 13% rise.

Who’s Driving Rental Demand?

According to JLL’s April 2025 report “The Residential Market in Poland,” a growing share of tenants consists of young professionals and international students. Therefore, investors should consider buying properties in academic hubs and urban centers that are expanding their business and educational infrastructure.

“In recent years, Katowice has enjoyed consistent interest from investors. It’s a city that attracts young people, businesses, and capital. In 2023, it was ranked the sixth top large city of the future in a prestigious fDi Intelligence report by the Financial Times. What’s more, Katowice boasts a registered unemployment rate of just 1%, compared to the national average of around 5%. Combined with apartment prices lower than in more competitive markets, this makes the city an attractive option for residential real estate investors.” — Adam Urbański, Sales Director, TDJ Estate

Not All Apartments Are Created Equal

Experts agree that in the current climate, it’s worth investing in properties that stand out—whether through architectural quality, location, or construction standards.

“An investment strategy should be tailored to a specific market segment. For example, it’s worth analyzing whether a given property will appeal to students and young professionals—in that case, proximity to universities and public transport is key. Other investors may prefer projects geared toward families—with access to green spaces, schools, or playgrounds.”— Marcin Krasoń, Otodom Analytics

A good example of this approach is the Pierwsza Dzielnica project by TDJ Estate. Located in the center of Katowice, right next to the Culture Zone, the development offers convenient access to urban infrastructure and cultural and educational amenities. The project features modern architecture, high construction standards, and functional urban design.

A key highlight is the numerous shared spaces for residents—such as coworking areas, a laundry room, and a gym—as well as planned greenery, which enhances the surroundings and promotes social integration. Such solutions increase the attractiveness of the investment, both in terms of daily living and long-term market value.